The FIFA World Cup kicks off this winter for the first ever time, breaking a 92-year-old precedent. So, how will the planet’s biggest sporting event affect peak trading for affiliate marketers?

Campaigns kicking off earlier

The timing of the World Cup will likely drive trading globally over a more prolonged period this Q4. Previous years’ data indicates brands increasingly start their Cyber Week promotions earlier and earlier. October 2021 saw steady year-on-year increases, with sales up 6% across several sectors. Fashion, health & beauty, home & garden and electronics are all sectors that witnessed positive sales growth compared to 2020.

In 2022, this trend will continue thanks to the World Cup. With matches coinciding with key trading days like Black Friday and Cyber Monday, brands around the world will want to offset the likelihood of shoppers being distracted by the tournament.

Some sectors, especially electronics, will likely execute longer periods of heightened marketing with leading offers launching earlier in October in an attempt to drive traffic and sales in advance of the football kicking off during Cyber Week. Promotions for products like televisions, projectors and soundbars will appear earlier as retailers aim to capture inevitable consumer demand.

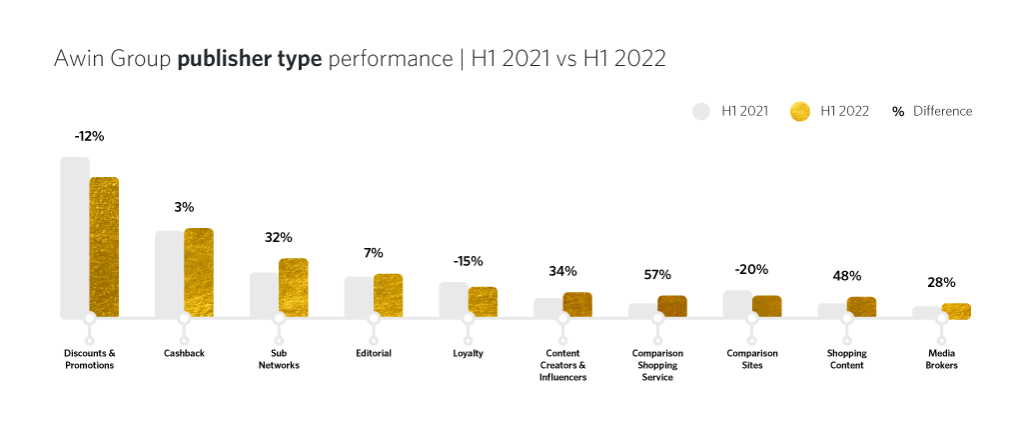

For affiliate marketers, content creators, media houses and CSS (Comparison Shopping Services) partners will be key allies during this time. At the time of writing, content publishers on Awin and ShareASale globally have seen an average increase of 20% in sales across our network in H1 2022 vs 2021 (Figure 1).

Robust growth from traditionally upper-funnel partners supports a trend of more considered purchasing lately. This has been exacerbated by inflation and the subsequent living increases. Consumers are conducting more research before committing to spend. Trusted opinion from review sites and influencers, for example, is driving increased sales compared to discount and cashback partners that are seeing lower or even negative growth.

CSS publishers have also risen in profile across Europe, with a 57% increase in H1 compared to 2021. While CSS partners on the platform have seen continually strong growth since the EU Commission’s anti-competition ruling against Google, they’ve seen the greatest percentage growth out of any publisher type this Q3. With European consumers getting savvier, CSS provides a comprehensive view of their market to filter and choose from, no matter the product they’re looking for. We expect this trend to continue as more advertisers realize the benefits of integrating CSS into their campaigns, providing better product coverage across a key discovery channel.

A winter of sports

While the World Cup’s timing will inevitably drag promotions ever earlier in Q4, the tournament’s length (the final doesn’t take place until December 18) means it may extend promotions even later than usual, too.

Historically, match days regularly witness spikes in demand from those watching across a range of sectors. Purchase behaviors during Euro 2020 highlighted this trend and sportswear brands will undoubtedly attract hordes of fans seeking replica shirts and other soccer paraphernalia as their teams compete.

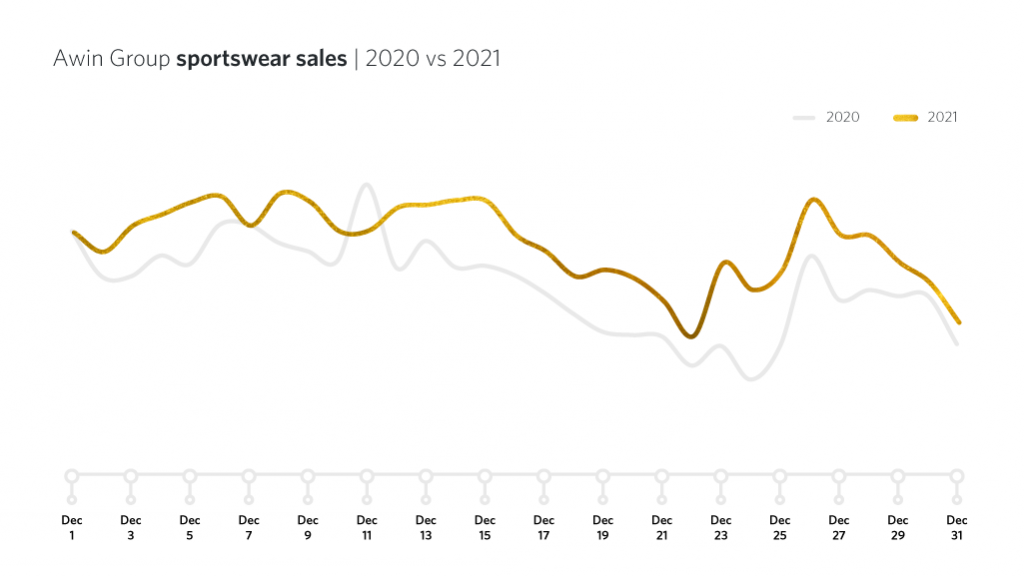

A popular choice for holiday gifting, December is frequently a strong month for sportswear retailers on Awin and ShareASale. December sales in 2021 were up 18% on the previous year’s volume (Figure 2) and we expect that to continue this year as the World Cup generates renewed demand from these brands.

Not to be left behind, we also expect a halo effect for other clothing retailers who will be putting a spotlight on their own athleisure and sportswear during this period, while home & garden and sports equipment advertisers will also likely see increased traffic and conversions for any soccer-related kit they sell.

Meeting demand at the right time

FMCG, alcohol and food & drink advertisers will also be looking to take advantage of World Cup match days, focusing their strategy and messaging to drive impulsive sales around games. The time-sensitive nature of these promotions requires a more dynamic marketing approach with clear calls-to-action (CTA). Therefore, discount and coupon code partners will invariably play a key role.

Takeout and food delivery advertisers are prime candidates for this type, using match-themed offers to quickly convert customers within the intended timeframe. The combination of time pressure and highly-targeted CTAs are a proven sales-driver while offering greater control for advertisers compared to an extended, generic promotional period.

Cost conscious shoppers will also be on the lookout for discounts and other savings in the lead up to big games when buying from FMCG retailers. The chance to buy in bulk on food & drink essentials and make larger savings may mean we see sales volume drop but average order values increase as shoppers aim to get more for their money. Expect spend-and-save codes as well as tiered cashback to be popular promotional offers, encouraging greater spend from consumers.

A World Cup clouded in uncertainty

Whether the current economic climate puts a damper on global soccer fever remains to be seen. Do not underestimate Europe’s (especially the UK’s) love for the game. Four million viewers tuned in for England’s opening match in this year’s Women’s Euros – almost double are expected for the World Cup.

With its coincidental timing during Q4’s peak, advertisers need to strike the right combination of enticing promotions and brand building activity across the extended period to ensure they’re front of mind for the world’s football fans.

Access the Awin Report 2022 to learn more about the 100 most innovative #Power100 partners on our global platform who can help you tackle the busiest trading period of the year.